Monday, 22/07/2024 | 07:13 GMT by Damian Chmiel

- The Federal Reserve slapped the digital bank for consumer protection violations.

- The CEO, however, claims that the fine pertains to old offenses, which the company has long since addressed.

The Federal Reserve (Fed) has imposed a hefty $44 million fine on Green Dot Corporation, a popular US-based digital bank, citing a litany of consumer protection violations and risk management deficiencies spanning at least five years.

Fed Slaps Green Dot with $44 Million Fine for Consumer Violations

The Austin-based company, known for its partnership with retail giants like Walmart, faced regulatory scrutiny for what the Fed described as “numerous unfair and deceptive practices” that occurred between 2017 and 2022. These infractions ranged from improperly blocking legitimate customer accounts to inadequate disclosure of fees associated with tax refund services.

According to the Fed report, “Green Dot violated consumer law in its marketing, selling, and servicing of prepaid debit card products, and its offering of tax return preparation payment services.”

The central bank highlighted several violations, including Green Dot’s failure to properly close accounts while continuing to assess fees and the company’s decision to discontinue phone registration for debit cards without adequately notifying customers.

The Fed’s action also mandates that Green Dot implement comprehensive compliance measures subject to regulatory approval, signaling a broader push for accountability in the fintech sector.

Green Dot CEO George Gresham acknowledged the company’s shortcomings in a statement, saying, ” We’ve been working closely with our regulators on these matters and are pleased to confirm the consent order has been finalized.”

However, as Gresham added, the penalty imposed by the Fed relates to practices used “years ago,” and since then, the company has undertaken a series of “meaningful steps” to address these issues. “We remain optimistic about our financial and regulatory positions as well as our future growth potential and opportunity as we serve and empower customers directly and through our partners,” Gresham concluded.

The penalty was imposed at the time when Green Dot appointed Mellisa Douros as Chief Product Officer. Previously, she served as the Vice President of Digital Product Experience at Discover Financial Services and was also associated with E*TRADE in the past.

Fintech vs. Regulations

The Fed’s decision comes amidst growing concerns over consumer protection in the rapidly evolving fintech landscape. As traditional banking services increasingly intersect with technology-driven solutions, regulators are grappling with how to ensure fair practices without stifling innovation.

At the beginning of this year, the need to regulate the sector was highlighted by Ashley Alder, the head of the FCA, who encouraged other regulators to engage in global collaboration in this field. Concurrently, the European Union approved new regulations targeting the payment market, a critical part of the financial technology industry. These regulations aim to challenge the dominance of major players such as Visa and Mastercard.

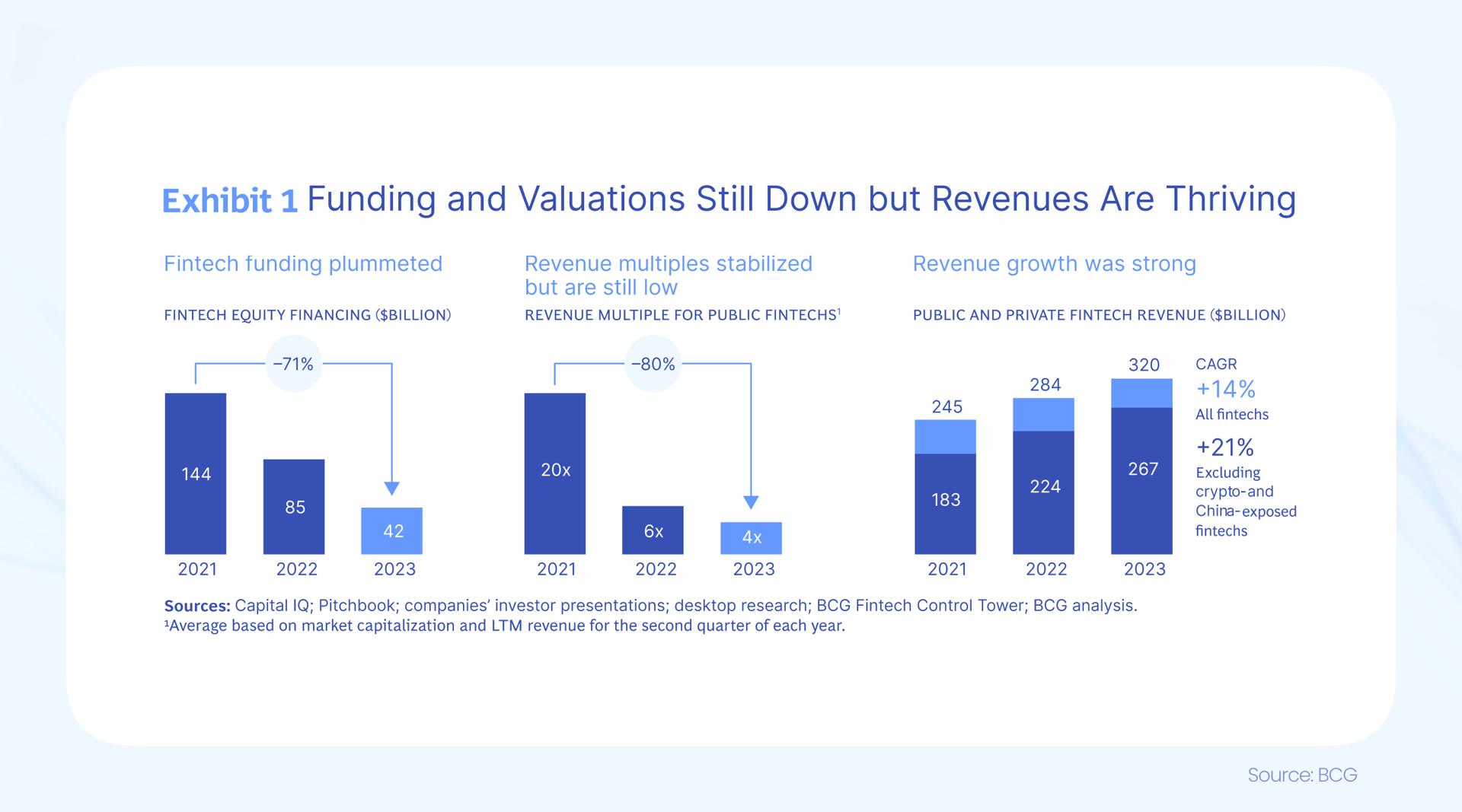

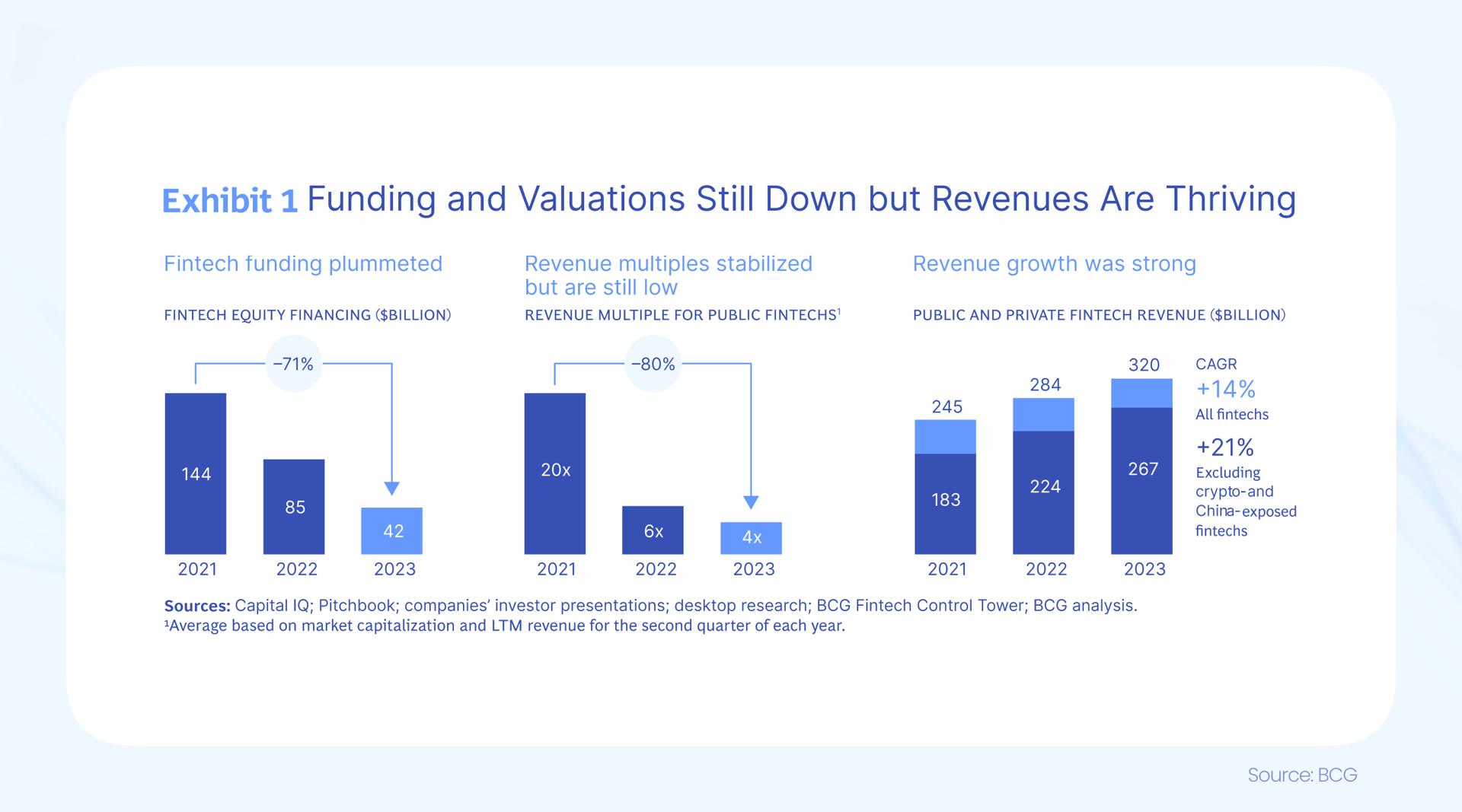

These developments are taking place at a time when the fintech sector is observing an increase in revenues, yet there is a significant 70% drop in funding. In 2021, funding amounted to $144 billion, which decreased to $42 billion in 2023.

An independent report from KPMG, highlighted by Finance Magnates in February, revealed that 2023 saw the lowest fintech funding results in the past five years. Global fintech investments fell to $113.7 billion in 2023, a substantial decline from $196.3 billion in 2022.

The Federal Reserve (Fed) has imposed a hefty $44 million fine on Green Dot Corporation, a popular US-based digital bank, citing a litany of consumer protection violations and risk management deficiencies spanning at least five years.

Fed Slaps Green Dot with $44 Million Fine for Consumer Violations

The Austin-based company, known for its partnership with retail giants like Walmart, faced regulatory scrutiny for what the Fed described as “numerous unfair and deceptive practices” that occurred between 2017 and 2022. These infractions ranged from improperly blocking legitimate customer accounts to inadequate disclosure of fees associated with tax refund services.

According to the Fed report, “Green Dot violated consumer law in its marketing, selling, and servicing of prepaid debit card products, and its offering of tax return preparation payment services.”

The central bank highlighted several violations, including Green Dot’s failure to properly close accounts while continuing to assess fees and the company’s decision to discontinue phone registration for debit cards without adequately notifying customers.

The Fed’s action also mandates that Green Dot implement comprehensive compliance measures subject to regulatory approval, signaling a broader push for accountability in the fintech sector.

Green Dot CEO George Gresham acknowledged the company’s shortcomings in a statement, saying, ” We’ve been working closely with our regulators on these matters and are pleased to confirm the consent order has been finalized.”

However, as Gresham added, the penalty imposed by the Fed relates to practices used “years ago,” and since then, the company has undertaken a series of “meaningful steps” to address these issues. “We remain optimistic about our financial and regulatory positions as well as our future growth potential and opportunity as we serve and empower customers directly and through our partners,” Gresham concluded.

The penalty was imposed at the time when Green Dot appointed Mellisa Douros as Chief Product Officer. Previously, she served as the Vice President of Digital Product Experience at Discover Financial Services and was also associated with E*TRADE in the past.

Fintech vs. Regulations

The Fed’s decision comes amidst growing concerns over consumer protection in the rapidly evolving fintech landscape. As traditional banking services increasingly intersect with technology-driven solutions, regulators are grappling with how to ensure fair practices without stifling innovation.

At the beginning of this year, the need to regulate the sector was highlighted by Ashley Alder, the head of the FCA, who encouraged other regulators to engage in global collaboration in this field. Concurrently, the European Union approved new regulations targeting the payment market, a critical part of the financial technology industry. These regulations aim to challenge the dominance of major players such as Visa and Mastercard.

These developments are taking place at a time when the fintech sector is observing an increase in revenues, yet there is a significant 70% drop in funding. In 2021, funding amounted to $144 billion, which decreased to $42 billion in 2023.

An independent report from KPMG, highlighted by Finance Magnates in February, revealed that 2023 saw the lowest fintech funding results in the past five years. Global fintech investments fell to $113.7 billion in 2023, a substantial decline from $196.3 billion in 2022.

Damian’s adventure with financial markets began at the Cracow University of Economics, where he obtained his MA in finance and accounting. Starting from the retail trader perspective, he collaborated with brokerage houses and financial portals in Poland as an independent editor and content manager. His adventure with Finance Magnates began in 2016, where he is working as a business intelligence analyst.

- 1631 Articles

- 36 Followers

Keep Reading

More from the Author

-

3rd Largest Bitcoin Miner on Wall Street Acquires Crypto Competitor for $93 Million

3rd Largest Bitcoin Miner on Wall Street Acquires Crypto Competitor for $93 Million

3rd Largest Bitcoin Miner on Wall Street Acquires Crypto Competitor for $93 Million

3rd Largest Bitcoin Miner on Wall Street Acquires Crypto Competitor for $93 Million

3rd Largest Bitcoin Miner on Wall Street Acquires Crypto Competitor for $93 Million

3rd Largest Bitcoin Miner on Wall Street Acquires Crypto Competitor for $93 Million

3rd Largest Bitcoin Miner on Wall Street Acquires Crypto Competitor for $93 Million

3rd Largest Bitcoin Miner on Wall Street Acquires Crypto Competitor for $93 Million

3rd Largest Bitcoin Miner on Wall Street Acquires Crypto Competitor for $93 Million

3rd Largest Bitcoin Miner on Wall Street Acquires Crypto Competitor for $93 Million

-

eToro to Add 1,000+ UK Stocks in LSE Partnership

eToro to Add 1,000+ UK Stocks in LSE Partnership

eToro to Add 1,000+ UK Stocks in LSE Partnership

eToro to Add 1,000+ UK Stocks in LSE Partnership

eToro to Add 1,000+ UK Stocks in LSE Partnership

eToro to Add 1,000+ UK Stocks in LSE Partnership

eToro to Add 1,000+ UK Stocks in LSE Partnership

eToro to Add 1,000+ UK Stocks in LSE Partnership

eToro to Add 1,000+ UK Stocks in LSE Partnership

eToro to Add 1,000+ UK Stocks in LSE Partnership

-

Broadridge Taps 30-Year APAC Veteran and Ex-LSEG Executive as New Regional President

Broadridge Taps 30-Year APAC Veteran and Ex-LSEG Executive as New Regional President

Broadridge Taps 30-Year APAC Veteran and Ex-LSEG Executive as New Regional President

Broadridge Taps 30-Year APAC Veteran and Ex-LSEG Executive as New Regional President

Broadridge Taps 30-Year APAC Veteran and Ex-LSEG Executive as New Regional President

Broadridge Taps 30-Year APAC Veteran and Ex-LSEG Executive as New Regional President

Broadridge Taps 30-Year APAC Veteran and Ex-LSEG Executive as New Regional President

Broadridge Taps 30-Year APAC Veteran and Ex-LSEG Executive as New Regional President

Broadridge Taps 30-Year APAC Veteran and Ex-LSEG Executive as New Regional President

Broadridge Taps 30-Year APAC Veteran and Ex-LSEG Executive as New Regional President

-

Breaking: Revolut Receives The UK Banking License after 3 Years of Efforts

Breaking: Revolut Receives The UK Banking License after 3 Years of Efforts

Breaking: Revolut Receives The UK Banking License after 3 Years of Efforts

Breaking: Revolut Receives The UK Banking License after 3 Years of Efforts

Breaking: Revolut Receives The UK Banking License after 3 Years of Efforts

Breaking: Revolut Receives The UK Banking License after 3 Years of Efforts

Breaking: Revolut Receives The UK Banking License after 3 Years of Efforts

Breaking: Revolut Receives The UK Banking License after 3 Years of Efforts

Breaking: Revolut Receives The UK Banking License after 3 Years of Efforts

Breaking: Revolut Receives The UK Banking License after 3 Years of Efforts

-

CMC Markets Reaffirms £360 Million Guidance as Revolut Deal Gains Traction

CMC Markets Reaffirms £360 Million Guidance as Revolut Deal Gains Traction

CMC Markets Reaffirms £360 Million Guidance as Revolut Deal Gains Traction

CMC Markets Reaffirms £360 Million Guidance as Revolut Deal Gains Traction

CMC Markets Reaffirms £360 Million Guidance as Revolut Deal Gains Traction

CMC Markets Reaffirms £360 Million Guidance as Revolut Deal Gains Traction

CMC Markets Reaffirms £360 Million Guidance as Revolut Deal Gains Traction

CMC Markets Reaffirms £360 Million Guidance as Revolut Deal Gains Traction

CMC Markets Reaffirms £360 Million Guidance as Revolut Deal Gains Traction

CMC Markets Reaffirms £360 Million Guidance as Revolut Deal Gains Traction

-

Sygnum’s Client Assets Hit $4.5 Billion amid Institutional Crypto Boom

Sygnum’s Client Assets Hit $4.5 Billion amid Institutional Crypto Boom

Sygnum’s Client Assets Hit $4.5 Billion amid Institutional Crypto Boom

Sygnum’s Client Assets Hit $4.5 Billion amid Institutional Crypto Boom

Sygnum’s Client Assets Hit $4.5 Billion amid Institutional Crypto Boom

Sygnum’s Client Assets Hit $4.5 Billion amid Institutional Crypto Boom

Sygnum’s Client Assets Hit $4.5 Billion amid Institutional Crypto Boom

Sygnum’s Client Assets Hit $4.5 Billion amid Institutional Crypto Boom

Sygnum’s Client Assets Hit $4.5 Billion amid Institutional Crypto Boom

Sygnum’s Client Assets Hit $4.5 Billion amid Institutional Crypto Boom

FinTech

-

Revolut Becomes a UK Bank, but What Does a ‘Mobilisation’ Stage Mean?

Revolut Becomes a UK Bank, but What Does a ‘Mobilisation’ Stage Mean?

Revolut Becomes a UK Bank, but What Does a ‘Mobilisation’ Stage Mean?

Revolut Becomes a UK Bank, but What Does a ‘Mobilisation’ Stage Mean?

Revolut Becomes a UK Bank, but What Does a ‘Mobilisation’ Stage Mean?

Revolut Becomes a UK Bank, but What Does a ‘Mobilisation’ Stage Mean?

Revolut Becomes a UK Bank, but What Does a ‘Mobilisation’ Stage Mean?

Revolut Becomes a UK Bank, but What Does a ‘Mobilisation’ Stage Mean?

Revolut Becomes a UK Bank, but What Does a ‘Mobilisation’ Stage Mean?

Revolut Becomes a UK Bank, but What Does a ‘Mobilisation’ Stage Mean?

-

Mastercard Gets in the Driver’s Seat with McLaren Racing’s Formula 1 Partnership

Mastercard Gets in the Driver’s Seat with McLaren Racing’s Formula 1 Partnership

Mastercard Gets in the Driver’s Seat with McLaren Racing’s Formula 1 Partnership

Mastercard Gets in the Driver’s Seat with McLaren Racing’s Formula 1 Partnership

Mastercard Gets in the Driver’s Seat with McLaren Racing’s Formula 1 Partnership

Mastercard Gets in the Driver’s Seat with McLaren Racing’s Formula 1 Partnership

Mastercard Gets in the Driver’s Seat with McLaren Racing’s Formula 1 Partnership

Mastercard Gets in the Driver’s Seat with McLaren Racing’s Formula 1 Partnership

Mastercard Gets in the Driver’s Seat with McLaren Racing’s Formula 1 Partnership

Mastercard Gets in the Driver’s Seat with McLaren Racing’s Formula 1 Partnership

-

Alipay+ Expands Global Reach Amidst UEFA EURO 2024 Surge

Alipay+ Expands Global Reach Amidst UEFA EURO 2024 Surge

Alipay+ Expands Global Reach Amidst UEFA EURO 2024 Surge

Alipay+ Expands Global Reach Amidst UEFA EURO 2024 Surge

Alipay+ Expands Global Reach Amidst UEFA EURO 2024 Surge

Alipay+ Expands Global Reach Amidst UEFA EURO 2024 Surge

Alipay+ Expands Global Reach Amidst UEFA EURO 2024 Surge

Alipay+ Expands Global Reach Amidst UEFA EURO 2024 Surge

Alipay+ Expands Global Reach Amidst UEFA EURO 2024 Surge

Alipay+ Expands Global Reach Amidst UEFA EURO 2024 Surge

-

ACI Worldwide and Worldpay: Strengthening the Backbone of Global Payments

ACI Worldwide and Worldpay: Strengthening the Backbone of Global Payments

ACI Worldwide and Worldpay: Strengthening the Backbone of Global Payments

ACI Worldwide and Worldpay: Strengthening the Backbone of Global Payments

ACI Worldwide and Worldpay: Strengthening the Backbone of Global Payments

ACI Worldwide and Worldpay: Strengthening the Backbone of Global Payments

ACI Worldwide and Worldpay: Strengthening the Backbone of Global Payments

ACI Worldwide and Worldpay: Strengthening the Backbone of Global Payments

ACI Worldwide and Worldpay: Strengthening the Backbone of Global Payments

ACI Worldwide and Worldpay: Strengthening the Backbone of Global Payments

-

U.S. Bank’s Automated Platform: A Game-Changer for Supplier Accounts Receivable

U.S. Bank’s Automated Platform: A Game-Changer for Supplier Accounts Receivable

U.S. Bank’s Automated Platform: A Game-Changer for Supplier Accounts Receivable

U.S. Bank’s Automated Platform: A Game-Changer for Supplier Accounts Receivable

U.S. Bank’s Automated Platform: A Game-Changer for Supplier Accounts Receivable

U.S. Bank’s Automated Platform: A Game-Changer for Supplier Accounts Receivable

U.S. Bank’s Automated Platform: A Game-Changer for Supplier Accounts Receivable

U.S. Bank’s Automated Platform: A Game-Changer for Supplier Accounts Receivable

U.S. Bank’s Automated Platform: A Game-Changer for Supplier Accounts Receivable

U.S. Bank’s Automated Platform: A Game-Changer for Supplier Accounts Receivable

-

Fiserv Reports Strong Q2 Results, Earnings Jump 39%

Fiserv Reports Strong Q2 Results, Earnings Jump 39%

Fiserv Reports Strong Q2 Results, Earnings Jump 39%

Fiserv Reports Strong Q2 Results, Earnings Jump 39%

Fiserv Reports Strong Q2 Results, Earnings Jump 39%

Fiserv Reports Strong Q2 Results, Earnings Jump 39%

Fiserv Reports Strong Q2 Results, Earnings Jump 39%

Fiserv Reports Strong Q2 Results, Earnings Jump 39%

Fiserv Reports Strong Q2 Results, Earnings Jump 39%

Fiserv Reports Strong Q2 Results, Earnings Jump 39%

-

Revolut Becomes a UK Bank, but What Does a ‘Mobilisation’ Stage Mean?

Revolut Becomes a UK Bank, but What Does a ‘Mobilisation’ Stage Mean?

-

Mastercard Gets in the Driver’s Seat with McLaren Racing’s Formula 1 Partnership

Mastercard Gets in the Driver’s Seat with McLaren Racing’s Formula 1 Partnership

-

Alipay+ Expands Global Reach Amidst UEFA EURO 2024 Surge

Alipay+ Expands Global Reach Amidst UEFA EURO 2024 Surge

-

ACI Worldwide and Worldpay: Strengthening the Backbone of Global Payments

ACI Worldwide and Worldpay: Strengthening the Backbone of Global Payments

Featured Videos

Sherwan Zeybo | FXGT | Executive Interviews

Sherwan Zeybo | FXGT | Executive Interviews

Sherwan Zeybo | FXGT | Executive Interviews

Sherwan Zeybo | FXGT | Executive Interviews

In this video, Sherwan Zeybo, Head of Business Development at @fxgtofficial , discusses the growth and development of the CFD broker since its inception in 2019. Starting with a small team, FXGT has expanded to over 280 employees and obtained multiple licenses across various jurisdictions. Sher highlights the broker’s commitment to providing security, transparency, and a comprehensive trading environment for clients. Sherwan also mentions upcoming developments, including a new trading app and a web trading platform, as well as a copy trading and social trading platform. #financemagnates #fmnews #FXGT #CFDBroker #TradingApp #FinancialServices #customersupport 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: https://www.linkedin.com/company/financemagnates/ 👍 Facebook: https://www.facebook.com/financemagnates/ 📸 Instagram: https://www.instagram.com/financemagnates_official 🐦 X (Twitter): https://twitter.com/financemagnates/ 📡 RSS Feed: https://www.financemagnates.com/feed/ ▶️ Telegram: https://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

In this video, Sherwan Zeybo, Head of Business Development at @fxgtofficial , discusses the growth and development of the CFD broker since its inception in 2019. Starting with a small team, FXGT has expanded to over 280 employees and obtained multiple licenses across various jurisdictions. Sher highlights the broker’s commitment to providing security, transparency, and a comprehensive trading environment for clients. Sherwan also mentions upcoming developments, including a new trading app and a web trading platform, as well as a copy trading and social trading platform. #financemagnates #fmnews #FXGT #CFDBroker #TradingApp #FinancialServices #customersupport 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: https://www.linkedin.com/company/financemagnates/ 👍 Facebook: https://www.facebook.com/financemagnates/ 📸 Instagram: https://www.instagram.com/financemagnates_official 🐦 X (Twitter): https://twitter.com/financemagnates/ 📡 RSS Feed: https://www.financemagnates.com/feed/ ▶️ Telegram: https://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

In this video, Sherwan Zeybo, Head of Business Development at @fxgtofficial , discusses the growth and development of the CFD broker since its inception in 2019. Starting with a small team, FXGT has expanded to over 280 employees and obtained multiple licenses across various jurisdictions. Sher highlights the broker’s commitment to providing security, transparency, and a comprehensive trading environment for clients. Sherwan also mentions upcoming developments, including a new trading app and a web trading platform, as well as a copy trading and social trading platform. #financemagnates #fmnews #FXGT #CFDBroker #TradingApp #FinancialServices #customersupport 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: https://www.linkedin.com/company/financemagnates/ 👍 Facebook: https://www.facebook.com/financemagnates/ 📸 Instagram: https://www.instagram.com/financemagnates_official 🐦 X (Twitter): https://twitter.com/financemagnates/ 📡 RSS Feed: https://www.financemagnates.com/feed/ ▶️ Telegram: https://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

In this video, Sherwan Zeybo, Head of Business Development at @fxgtofficial , discusses the growth and development of the CFD broker since its inception in 2019. Starting with a small team, FXGT has expanded to over 280 employees and obtained multiple licenses across various jurisdictions. Sher highlights the broker’s commitment to providing security, transparency, and a comprehensive trading environment for clients. Sherwan also mentions upcoming developments, including a new trading app and a web trading platform, as well as a copy trading and social trading platform. #financemagnates #fmnews #FXGT #CFDBroker #TradingApp #FinancialServices #customersupport 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: https://www.linkedin.com/company/financemagnates/ 👍 Facebook: https://www.facebook.com/financemagnates/ 📸 Instagram: https://www.instagram.com/financemagnates_official 🐦 X (Twitter): https://twitter.com/financemagnates/ 📡 RSS Feed: https://www.financemagnates.com/feed/ ▶️ Telegram: https://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

-

Remonda Z. Kirketerp-Møller | Muinmos

Remonda Z. Kirketerp-Møller | Muinmos

Remonda Z. Kirketerp-Møller | Muinmos

Remonda Z. Kirketerp-Møller | Muinmos

Remonda Z. Kirketerp-Møller | Muinmos

Remonda Z. Kirketerp-Møller | Muinmos

In our discussion with Rhonda K. Müller, CEO of Muinmos, during iFX EXPO International, she covered regulatory changes impacting the trading industry, particularly focusing on new frameworks like MICA and Dora. She highlights the positive effects of regulation, such as increased order and transparency, and predicts that these changes will ignite more competition in the crypto market. Rhonda also touches on the rising trend of prop trading and anticipates future regulations in this area to ensure legitimacy. Finally, she shares Mooz’s commitment to digitization and connectivity, aiming to provide comprehensive solutions from investor protection to risk profiling. #financemagnates #Regulation #CryptoTrading #PropTrading #FinancialMarkets #DigitalTransformation 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: https://www.linkedin.com/company/financemagnates/ 👍 Facebook: https://www.facebook.com/financemagnates/ 📸 Instagram: https://www.instagram.com/financemagnates_official 🐦 X (Twitter): https://twitter.com/financemagnates/ 📡 RSS Feed: https://www.financemagnates.com/feed/ ▶️ Telegram: https://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

In our discussion with Rhonda K. Müller, CEO of Muinmos, during iFX EXPO International, she covered regulatory changes impacting the trading industry, particularly focusing on new frameworks like MICA and Dora. She highlights the positive effects of regulation, such as increased order and transparency, and predicts that these changes will ignite more competition in the crypto market. Rhonda also touches on the rising trend of prop trading and anticipates future regulations in this area to ensure legitimacy. Finally, she shares Mooz’s commitment to digitization and connectivity, aiming to provide comprehensive solutions from investor protection to risk profiling. #financemagnates #Regulation #CryptoTrading #PropTrading #FinancialMarkets #DigitalTransformation 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: https://www.linkedin.com/company/financemagnates/ 👍 Facebook: https://www.facebook.com/financemagnates/ 📸 Instagram: https://www.instagram.com/financemagnates_official 🐦 X (Twitter): https://twitter.com/financemagnates/ 📡 RSS Feed: https://www.financemagnates.com/feed/ ▶️ Telegram: https://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

In our discussion with Rhonda K. Müller, CEO of Muinmos, during iFX EXPO International, she covered regulatory changes impacting the trading industry, particularly focusing on new frameworks like MICA and Dora. She highlights the positive effects of regulation, such as increased order and transparency, and predicts that these changes will ignite more competition in the crypto market. Rhonda also touches on the rising trend of prop trading and anticipates future regulations in this area to ensure legitimacy. Finally, she shares Mooz’s commitment to digitization and connectivity, aiming to provide comprehensive solutions from investor protection to risk profiling. #financemagnates #Regulation #CryptoTrading #PropTrading #FinancialMarkets #DigitalTransformation 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: https://www.linkedin.com/company/financemagnates/ 👍 Facebook: https://www.facebook.com/financemagnates/ 📸 Instagram: https://www.instagram.com/financemagnates_official 🐦 X (Twitter): https://twitter.com/financemagnates/ 📡 RSS Feed: https://www.financemagnates.com/feed/ ▶️ Telegram: https://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

In our discussion with Rhonda K. Müller, CEO of Muinmos, during iFX EXPO International, she covered regulatory changes impacting the trading industry, particularly focusing on new frameworks like MICA and Dora. She highlights the positive effects of regulation, such as increased order and transparency, and predicts that these changes will ignite more competition in the crypto market. Rhonda also touches on the rising trend of prop trading and anticipates future regulations in this area to ensure legitimacy. Finally, she shares Mooz’s commitment to digitization and connectivity, aiming to provide comprehensive solutions from investor protection to risk profiling. #financemagnates #Regulation #CryptoTrading #PropTrading #FinancialMarkets #DigitalTransformation 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: https://www.linkedin.com/company/financemagnates/ 👍 Facebook: https://www.facebook.com/financemagnates/ 📸 Instagram: https://www.instagram.com/financemagnates_official 🐦 X (Twitter): https://twitter.com/financemagnates/ 📡 RSS Feed: https://www.financemagnates.com/feed/ ▶️ Telegram: https://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

In our discussion with Rhonda K. Müller, CEO of Muinmos, during iFX EXPO International, she covered regulatory changes impacting the trading industry, particularly focusing on new frameworks like MICA and Dora. She highlights the positive effects of regulation, such as increased order and transparency, and predicts that these changes will ignite more competition in the crypto market. Rhonda also touches on the rising trend of prop trading and anticipates future regulations in this area to ensure legitimacy. Finally, she shares Mooz’s commitment to digitization and connectivity, aiming to provide comprehensive solutions from investor protection to risk profiling. #financemagnates #Regulation #CryptoTrading #PropTrading #FinancialMarkets #DigitalTransformation 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: https://www.linkedin.com/company/financemagnates/ 👍 Facebook: https://www.facebook.com/financemagnates/ 📸 Instagram: https://www.instagram.com/financemagnates_official 🐦 X (Twitter): https://twitter.com/financemagnates/ 📡 RSS Feed: https://www.financemagnates.com/feed/ ▶️ Telegram: https://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

In our discussion with Rhonda K. Müller, CEO of Muinmos, during iFX EXPO International, she covered regulatory changes impacting the trading industry, particularly focusing on new frameworks like MICA and Dora. She highlights the positive effects of regulation, such as increased order and transparency, and predicts that these changes will ignite more competition in the crypto market. Rhonda also touches on the rising trend of prop trading and anticipates future regulations in this area to ensure legitimacy. Finally, she shares Mooz’s commitment to digitization and connectivity, aiming to provide comprehensive solutions from investor protection to risk profiling. #financemagnates #Regulation #CryptoTrading #PropTrading #FinancialMarkets #DigitalTransformation 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: https://www.linkedin.com/company/financemagnates/ 👍 Facebook: https://www.facebook.com/financemagnates/ 📸 Instagram: https://www.instagram.com/financemagnates_official 🐦 X (Twitter): https://twitter.com/financemagnates/ 📡 RSS Feed: https://www.financemagnates.com/feed/ ▶️ Telegram: https://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

-

Tom Higgins | Gold-i

Tom Higgins | Gold-i

Tom Higgins | Gold-i

Tom Higgins | Gold-i

Tom Higgins | Gold-i

Tom Higgins | Gold-i

In this interview, Tom Higgins, CEO of Gold-i, discusses the convergence of crypto and FX liquidity. He explains the challenges of accessing crypto liquidity and how different execution methods, such as iceberg orders, help manage large transactions. Tom addresses the impact of AI in trading, emphasizing its use in sentiment analysis and trading pattern recognition. He also talks about the significance of Bitcoin ETFs in boosting institutional confidence in crypto markets. Lastly, Tom outlines the growth and future plans for Gold-i, focusing on enhancing their Matrix Net technology and expanding their role in crypto liquidity aggregation. #financemagnates #CryptoLiquidity #FXLiquidity #AIinTrading #BitcoinETF #TradingTechnology 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: https://www.linkedin.com/company/financemagnates/ 👍 Facebook: https://www.facebook.com/financemagnates/ 📸 Instagram: https://www.instagram.com/financemagnates_official 🐦 X (Twitter): https://twitter.com/financemagnates/ 📡 RSS Feed: https://www.financemagnates.com/feed/ ▶️ Telegram: https://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

In this interview, Tom Higgins, CEO of Gold-i, discusses the convergence of crypto and FX liquidity. He explains the challenges of accessing crypto liquidity and how different execution methods, such as iceberg orders, help manage large transactions. Tom addresses the impact of AI in trading, emphasizing its use in sentiment analysis and trading pattern recognition. He also talks about the significance of Bitcoin ETFs in boosting institutional confidence in crypto markets. Lastly, Tom outlines the growth and future plans for Gold-i, focusing on enhancing their Matrix Net technology and expanding their role in crypto liquidity aggregation. #financemagnates #CryptoLiquidity #FXLiquidity #AIinTrading #BitcoinETF #TradingTechnology 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: https://www.linkedin.com/company/financemagnates/ 👍 Facebook: https://www.facebook.com/financemagnates/ 📸 Instagram: https://www.instagram.com/financemagnates_official 🐦 X (Twitter): https://twitter.com/financemagnates/ 📡 RSS Feed: https://www.financemagnates.com/feed/ ▶️ Telegram: https://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

In this interview, Tom Higgins, CEO of Gold-i, discusses the convergence of crypto and FX liquidity. He explains the challenges of accessing crypto liquidity and how different execution methods, such as iceberg orders, help manage large transactions. Tom addresses the impact of AI in trading, emphasizing its use in sentiment analysis and trading pattern recognition. He also talks about the significance of Bitcoin ETFs in boosting institutional confidence in crypto markets. Lastly, Tom outlines the growth and future plans for Gold-i, focusing on enhancing their Matrix Net technology and expanding their role in crypto liquidity aggregation. #financemagnates #CryptoLiquidity #FXLiquidity #AIinTrading #BitcoinETF #TradingTechnology 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: https://www.linkedin.com/company/financemagnates/ 👍 Facebook: https://www.facebook.com/financemagnates/ 📸 Instagram: https://www.instagram.com/financemagnates_official 🐦 X (Twitter): https://twitter.com/financemagnates/ 📡 RSS Feed: https://www.financemagnates.com/feed/ ▶️ Telegram: https://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

In this interview, Tom Higgins, CEO of Gold-i, discusses the convergence of crypto and FX liquidity. He explains the challenges of accessing crypto liquidity and how different execution methods, such as iceberg orders, help manage large transactions. Tom addresses the impact of AI in trading, emphasizing its use in sentiment analysis and trading pattern recognition. He also talks about the significance of Bitcoin ETFs in boosting institutional confidence in crypto markets. Lastly, Tom outlines the growth and future plans for Gold-i, focusing on enhancing their Matrix Net technology and expanding their role in crypto liquidity aggregation. #financemagnates #CryptoLiquidity #FXLiquidity #AIinTrading #BitcoinETF #TradingTechnology 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: https://www.linkedin.com/company/financemagnates/ 👍 Facebook: https://www.facebook.com/financemagnates/ 📸 Instagram: https://www.instagram.com/financemagnates_official 🐦 X (Twitter): https://twitter.com/financemagnates/ 📡 RSS Feed: https://www.financemagnates.com/feed/ ▶️ Telegram: https://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

In this interview, Tom Higgins, CEO of Gold-i, discusses the convergence of crypto and FX liquidity. He explains the challenges of accessing crypto liquidity and how different execution methods, such as iceberg orders, help manage large transactions. Tom addresses the impact of AI in trading, emphasizing its use in sentiment analysis and trading pattern recognition. He also talks about the significance of Bitcoin ETFs in boosting institutional confidence in crypto markets. Lastly, Tom outlines the growth and future plans for Gold-i, focusing on enhancing their Matrix Net technology and expanding their role in crypto liquidity aggregation. #financemagnates #CryptoLiquidity #FXLiquidity #AIinTrading #BitcoinETF #TradingTechnology 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: https://www.linkedin.com/company/financemagnates/ 👍 Facebook: https://www.facebook.com/financemagnates/ 📸 Instagram: https://www.instagram.com/financemagnates_official 🐦 X (Twitter): https://twitter.com/financemagnates/ 📡 RSS Feed: https://www.financemagnates.com/feed/ ▶️ Telegram: https://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

In this interview, Tom Higgins, CEO of Gold-i, discusses the convergence of crypto and FX liquidity. He explains the challenges of accessing crypto liquidity and how different execution methods, such as iceberg orders, help manage large transactions. Tom addresses the impact of AI in trading, emphasizing its use in sentiment analysis and trading pattern recognition. He also talks about the significance of Bitcoin ETFs in boosting institutional confidence in crypto markets. Lastly, Tom outlines the growth and future plans for Gold-i, focusing on enhancing their Matrix Net technology and expanding their role in crypto liquidity aggregation. #financemagnates #CryptoLiquidity #FXLiquidity #AIinTrading #BitcoinETF #TradingTechnology 📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today: 🔗 LinkedIn: https://www.linkedin.com/company/financemagnates/ 👍 Facebook: https://www.facebook.com/financemagnates/ 📸 Instagram: https://www.instagram.com/financemagnates_official 🐦 X (Twitter): https://twitter.com/financemagnates/ 📡 RSS Feed: https://www.financemagnates.com/feed/ ▶️ Telegram: https://t.me/financemagnatesnews Don’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

-

Throwback to FMLS:23 | FMvoices

Throwback to FMLS:23 | FMvoices

Throwback to FMLS:23 | FMvoices

Throwback to FMLS:23 | FMvoices

Throwback to FMLS:23 | FMvoices

Throwback to FMLS:23 | FMvoices

FMvoices are here to confirm all the great things you’ve heard about our events ✨ At the same time, it’s a throwback to our very successful FMLS:23 and we want to give out a special thank you to everyone who took the time to talk to us during the busy hours of the expo! Ugnė B., payabl. Joe Pelley, ActivTrades William Thomas, BVNK Got FOMO? Register now and secure your spot to the most premium financial event of London 🔗 https://events.financemagnates.com/EmKzD?utm_source=linkedin&utm_campaign=FMvoices-FMLS23&utm_medium=video&RefId=FMvoices+FMLS23 #fmls24 #fmls24 #fmls #fmevents #London #networking #financesummit 📣 Stay updated with the latest in finance and trading! Follow FMevents across our social media platforms for news, insights, and event updates. Connect with us today: 🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/ 👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents 📸 Instagram: https://www.instagram.com/fmevents_official 🐦 Twitter: https://twitter.com/F_M_events 🎥 TikTok: https://www.tiktok.com/@fmevents_official ▶️ YouTube: https://www.youtube.com/@FinanceMagnates_official Don’t miss out on our latest videos, interviews, and event coverage. Subscribe to our YouTube channel for more!

FMvoices are here to confirm all the great things you’ve heard about our events ✨ At the same time, it’s a throwback to our very successful FMLS:23 and we want to give out a special thank you to everyone who took the time to talk to us during the busy hours of the expo! Ugnė B., payabl. Joe Pelley, ActivTrades William Thomas, BVNK Got FOMO? Register now and secure your spot to the most premium financial event of London 🔗 https://events.financemagnates.com/EmKzD?utm_source=linkedin&utm_campaign=FMvoices-FMLS23&utm_medium=video&RefId=FMvoices+FMLS23 #fmls24 #fmls24 #fmls #fmevents #London #networking #financesummit 📣 Stay updated with the latest in finance and trading! Follow FMevents across our social media platforms for news, insights, and event updates. Connect with us today: 🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/ 👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents 📸 Instagram: https://www.instagram.com/fmevents_official 🐦 Twitter: https://twitter.com/F_M_events 🎥 TikTok: https://www.tiktok.com/@fmevents_official ▶️ YouTube: https://www.youtube.com/@FinanceMagnates_official Don’t miss out on our latest videos, interviews, and event coverage. Subscribe to our YouTube channel for more!

FMvoices are here to confirm all the great things you’ve heard about our events ✨ At the same time, it’s a throwback to our very successful FMLS:23 and we want to give out a special thank you to everyone who took the time to talk to us during the busy hours of the expo! Ugnė B., payabl. Joe Pelley, ActivTrades William Thomas, BVNK Got FOMO? Register now and secure your spot to the most premium financial event of London 🔗 https://events.financemagnates.com/EmKzD?utm_source=linkedin&utm_campaign=FMvoices-FMLS23&utm_medium=video&RefId=FMvoices+FMLS23 #fmls24 #fmls24 #fmls #fmevents #London #networking #financesummit 📣 Stay updated with the latest in finance and trading! Follow FMevents across our social media platforms for news, insights, and event updates. Connect with us today: 🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/ 👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents 📸 Instagram: https://www.instagram.com/fmevents_official 🐦 Twitter: https://twitter.com/F_M_events 🎥 TikTok: https://www.tiktok.com/@fmevents_official ▶️ YouTube: https://www.youtube.com/@FinanceMagnates_official Don’t miss out on our latest videos, interviews, and event coverage. Subscribe to our YouTube channel for more!

FMvoices are here to confirm all the great things you’ve heard about our events ✨ At the same time, it’s a throwback to our very successful FMLS:23 and we want to give out a special thank you to everyone who took the time to talk to us during the busy hours of the expo! Ugnė B., payabl. Joe Pelley, ActivTrades William Thomas, BVNK Got FOMO? Register now and secure your spot to the most premium financial event of London 🔗 https://events.financemagnates.com/EmKzD?utm_source=linkedin&utm_campaign=FMvoices-FMLS23&utm_medium=video&RefId=FMvoices+FMLS23 #fmls24 #fmls24 #fmls #fmevents #London #networking #financesummit 📣 Stay updated with the latest in finance and trading! Follow FMevents across our social media platforms for news, insights, and event updates. Connect with us today: 🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/ 👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents 📸 Instagram: https://www.instagram.com/fmevents_official 🐦 Twitter: https://twitter.com/F_M_events 🎥 TikTok: https://www.tiktok.com/@fmevents_official ▶️ YouTube: https://www.youtube.com/@FinanceMagnates_official Don’t miss out on our latest videos, interviews, and event coverage. Subscribe to our YouTube channel for more!

FMvoices are here to confirm all the great things you’ve heard about our events ✨ At the same time, it’s a throwback to our very successful FMLS:23 and we want to give out a special thank you to everyone who took the time to talk to us during the busy hours of the expo! Ugnė B., payabl. Joe Pelley, ActivTrades William Thomas, BVNK Got FOMO? Register now and secure your spot to the most premium financial event of London 🔗 https://events.financemagnates.com/EmKzD?utm_source=linkedin&utm_campaign=FMvoices-FMLS23&utm_medium=video&RefId=FMvoices+FMLS23 #fmls24 #fmls24 #fmls #fmevents #London #networking #financesummit 📣 Stay updated with the latest in finance and trading! Follow FMevents across our social media platforms for news, insights, and event updates. Connect with us today: 🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/ 👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents 📸 Instagram: https://www.instagram.com/fmevents_official 🐦 Twitter: https://twitter.com/F_M_events 🎥 TikTok: https://www.tiktok.com/@fmevents_official ▶️ YouTube: https://www.youtube.com/@FinanceMagnates_official Don’t miss out on our latest videos, interviews, and event coverage. Subscribe to our YouTube channel for more!

FMvoices are here to confirm all the great things you’ve heard about our events ✨ At the same time, it’s a throwback to our very successful FMLS:23 and we want to give out a special thank you to everyone who took the time to talk to us during the busy hours of the expo! Ugnė B., payabl. Joe Pelley, ActivTrades William Thomas, BVNK Got FOMO? Register now and secure your spot to the most premium financial event of London 🔗 https://events.financemagnates.com/EmKzD?utm_source=linkedin&utm_campaign=FMvoices-FMLS23&utm_medium=video&RefId=FMvoices+FMLS23 #fmls24 #fmls24 #fmls #fmevents #London #networking #financesummit 📣 Stay updated with the latest in finance and trading! Follow FMevents across our social media platforms for news, insights, and event updates. Connect with us today: 🔗 LinkedIn: https://www.linkedin.com/showcase/financemagnates-events/ 👍 Facebook: https://www.facebook.com/FinanceMagnatesEvents 📸 Instagram: https://www.instagram.com/fmevents_official 🐦 Twitter: https://twitter.com/F_M_events 🎥 TikTok: https://www.tiktok.com/@fmevents_official ▶️ YouTube: https://www.youtube.com/@FinanceMagnates_official Don’t miss out on our latest videos, interviews, and event coverage. Subscribe to our YouTube channel for more!

-

FMvoices are here to confirm all the great things you’ve heard about our events ✨ #fmevents #fmls24

FMvoices are here to confirm all the great things you’ve heard about our events ✨ #fmevents #fmls24

FMvoices are here to confirm all the great things you’ve heard about our events ✨ #fmevents #fmls24

FMvoices are here to confirm all the great things you’ve heard about our events ✨ #fmevents #fmls24

FMvoices are here to confirm all the great things you’ve heard about our events ✨ #fmevents #fmls24

FMvoices are here to confirm all the great things you’ve heard about our events ✨ #fmevents #fmls24